- 0

By Steve Menary

15 March 2011

Clubs from the Premier League owe millions of pounds in tax payments, including VAT, despite being rich enough to pay player’s salaries that run into six figures per week in some cases, according to findings from a Freedom of Information inquiry (FOI) published for the first time here today.

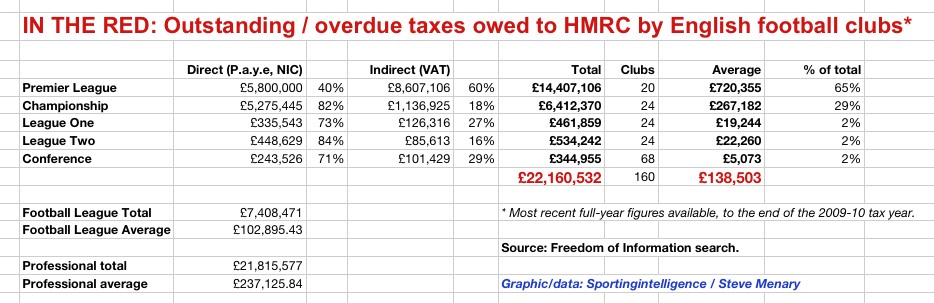

The precise tally changes from month to month but an FOI inquiry seeking figures for the end of the last tax year (April 2010) has revealed that more than £22m in ‘simple‘ taxes (PAYE, National Insurance and VAT) was overdue to Her Majesty’s Revenue & Customs (HMRC) by the 92 clubs in the Premier League and Football League.

As is revealed in sportingintelligence’s exclusive table today, the Premier League’s 20 clubs collectively owed £14.4m – and £8.6m in VAT alone in the period in question.

Championship clubs owed £6.4m, and the 72 clubs of the Football League collectively owed £7.4m.

These new FOI findings will be used by the fans’ group, Supporters Direct, to support a change of the football creditors rule. SD will today make a submission to Parliament’s ongoing enquiry into the governance of football.

Dave Boyle, the Supporters Direct chief executive and a contributing columnist to this website, says: “Football clubs make great play of being engaged in their communities, but that rings hollow if clubs don’t contribute to their communities by paying their tax on time, especially in the current economic and fiscal climate.

“It’s important to recognise that the game has been making progress to tackle these issues, but these figures highlight how far there is to go. We think it’s yet another piece of evidence underscoring the need for a thorough-going licensing regime across the professional game and the Conference.”

The significance in these numbers is that they represent the ‘simple’ tax debts at 30 April 2010, just after the tax year had ended and most payments to HMRC would have been paid. As such, these figures were almost certainly the ‘low ebb’ snapshot of 2010.

.

.

By early June 2010, just six weeks later, another FOI inquiry by the Taxpayers’ Alliance showed that the 20 Premier League clubs combined owed more than £27.4m in PAYE and NIC alone (up from £5.8m in five weeks), while the 72 clubs of the Football League owed £3.6m. These figures did not include VAT debt.

The Premier League’s surge in owed tax between the end of April and early June was influenced partly but not wholly by HMRC recalculating the extent of ailing Portsmouth’s liabilities.

“Clearly Portsmouth FC ran up significant debt to numerous creditors, including HMRC,” says Dan Johnson, the Premier League’s head of communications. “However, the Premier League’s starting position is that there should be no debt to HMRC, which is why we have introduced a raft of financial criteria to encourage clubs to run themselves in a responsible and sustainable manner.

“This includes quarterly reporting on any overdue HMRC payments and the ability to intervene if clubs get behind.

“When combined with HMRC’s new policy of, quite rightly, not permitting clubs to run up debts over time, this will more than mitigate this issue going forward.”

The state of the 2010 debts is revealed as the Premier League prepares for a legal battle with HMRC over the validity of the so-called ‘football creditors rule’ (FCR). The FCR dictates that when clubs get into financial difficulties, ‘football creditors’ (players, other clubs) get priority treatment and must be paid in full, whereas other creditors (including the tax man) can end up with a few pence in the pound.

HMRC believes that the FCR is unfair and is challenging the Premier League in the High Court.

The FCR has been described as “morally indefensible” (by Lord Mawhinney among others) because it costs the public purse at the expense of football.

Some arms of the “football family” privately acknowledge the FCR’s flaws but say it serves the greater good of football, and therefore communities, by preventing harmful knock-on effects that would unfold if it wasn’t in place.

If club W goes bust owing smaller clubs X, Y and Z money for players, those smaller clubs would be damaged without the FCR in place.

The HMRC v Premier League case was due in court on 15 February but postponed while the High Court heard another legal dispute between Lehman Brothers Special Financing Inc and Belmont Park Investments PTY. This case is not linked to the FCR challenge at all, but HMRC believe that the Lehman/Belmont case did touch on one of the key principles in its argument against the Premier League.

The Lehman/Belmont case has now passed and the preliminary hearing for the FCR case was heard yesterday, 14 March, with the actual hearing to discuss a challenge that could change the face of football expected in two weeks.

Since November last year, HMRC has carried out an internal exercise aimed at identifying the parent companies of clubs in the Premier and Football Leagues as part of a crackdown on tax avoidance.

We can reveal that a specialist HMRC team has been set up at a dedicated office in Worthing, Sussex.

The results in our table split up money owed in direct tax (PAYE and National Insurance Contributions) and debts due to HMRC from clubs for indirect tax, which is VAT.

The 20 clubs in the Premier League at the end of the 2009-10 tax year, including Portsmouth, who subsequently sank into administration, owed an average of nearly three quarters of a million pounds each, or £720,355 each to be precise.

On top of the findings we publish in the table today, clubs in the Welsh Premier League owed £42,583 at the end of the last tax year according to the FOI request.

The same request showed that HMRC issued 40 petitions in 2010 against the limited companies that own clubs in the Premier League, Football League, three divisions of the Conference and the Welsh Premier League.

A number of those were repeat petitions issued against the owners of clubs engaged in serial brinksmanship with the taxman, notably Cardiff City’s old owners and Southend United.

HMRC cannot disclose individual clubs’ names for reasons of confidentiality but sportingintelligence has identified 19 clubs in the top seven tiers of the English football pyramid that were subject to winding up orders during 2010 (see list at bottom).

Yet the new HMRC data suggests more clubs were petitioned than those in the list below.

“HMRC does not initiate winding up proceedings of football clubs lightly,” said an HMRC spokesman. “However we will not hesitate to do so when that is the right way to protect the country’s tax revenues and other creditors from those who trade whilst insolvent and run up debts that they simply cannot pay.”

Outside the top seven tiers in England, the Isthmian League pair of Ashford Town and Folkestone Invicta, plus Bradford Park Avenue and Burscough of the Northern Premier League were all subject to winding-up petitions in 2010.

Southern League Premier Division sides Merthyr Tydfil and Windsor & Eton also faced winding-up petitions last year, while beyond England and Wales, tax authorities sought a similar order against Dundee in 2010 and Falkirk this year, while two Northern Irish clubs, Glentoran and Newry, were subject to petitions by the province’s tax authorities during 2010.

Outside football, in 2010 HMRC also sought to wind up Oldham and Wakefield Trinity rugby league clubs and Darlington rugby union side.

So far this year, HMRC has sought winding-up petitions against Kidderminster Harriers, Plymouth Argyle and Windsor & Eton.

Like Plymouth, Windsor & Eton were subject to repeated petitions and the Berkshire side was recently wound up, while in 2010 Ashford Town, Bromsgrove Rovers, Farsley Celtic, Chester City, Ilkeston Town, Merthyr Tydfil and Nelson were all also wound up over debts that including money owed to the taxman.

In 2008, a BBC investigation claimed that more than £28m of tax money owed by English clubs had been written off by HMRC.

Between 2000 and 2008, 42 professional clubs in the Football League and the lower divisions such as the Football Conference went into administration – some more than once – and the BBC estimated the tax debt run up by 18 of those clubs. According to the BBC, one club, Leicester City settled just 10 per cent of a £7m tax bill.

Businesses losing at a pre-tax level do not have to pay tax and can claim relief in future years against those losses.

In response to the latest FOI, the Football League’s head of communications John Nagle said: “This figure of £7.4m at the end of the last tax year actually gives a misleading impression of the true state of club finances. This is because it reflects the position at a single point in time during a season of significant transition in terms of clubs’ overall tax liabilities.

“In 2009, the Football League pioneered new financial regulations relating to tax payments. These provided the League with written permission to monitor the PAYE of its clubs directly with HMRC and impose transfer embargoes in instances where clubs fail to meet their tax debts as and when they fall due.”

In August 2009, 29 clubs Football League clubs owed money to HMRC. The total due then was £9.6 million and Mr Nagle says that by August 2010, only four Football League clubs owed money to HMRC and the total due was a mere £400,000.

This suggests more than £7m in tax debt was paid by Football League clubs between the end of April and August last year. “I can’t vouch for those [June] figures [showing £3.6m owed],” added Mr Nagle. “All I can do is confirm that the ones I’ve given … are accurate as far as we are concerned.”

Since last summer, HMRC has taken a more hard-line approach, partly in response to Portsmouth becoming the first Premier League club to go into administration. That failure led HMRC to challenge the Premier League over a rule that sees football-related debts such as salaries and player transfers paid out first if a club goes into administration.

Asked to comment on the new FOI results, HMRC declined but a spokesman did reiterate its position over the FCR, saying: “HMRC’s view is that the FCR is unfair, unlawful and unacceptable, which is why we are challenging it in the courts. There is no legal basis to the FCR, and non football creditors are being seriously short changed, so enough is enough.”

If HMRC win its challenge with the Premier League over the FCR, the ruling is expected to apply to all football clubs in England. Experts suggest that the knock-on effect will be that if players are no longer certain of receiving all their money for the duration of a contract if a club goes into administration, then the players – and their agents – will simply ask for more money up front.

.

HMRC Winding-up petitions sought in 2010 against clubs then in the Premier League, Football League and the Blue Square Premier, North and South

Accrington Stanley, AFC Bournemouth, Bishop Stortford, Cardiff City, Chester City, Crawley, Crystal Palace, Dorchester Town, Forest Green Rovers, Hinckley United, Ilkeston Town, Lewes, Notts County, Plymouth Argyle, Portsmouth, Preston North End, Sheffield Wednesday, Southend United, Welling United.

.