- 4

8 April 2010

As an academic with an interest in economic analysis, the downfall of the English teams in the Champions League this season did not surprise me, even while it disappointed me as a Manchester United fan.

Earlier this season, I was actually expecting that the English teams would “under-perform” in the competition, when set against general expectations, and now that United have followed Arsenal, Chelsea and Liverpool out of the Champions League, they have done so. Except I would argue they did not actually under-perform; they did what economic analysis suggested might happen.

The main reason I thought they could struggle is the downfall of the pound. No doubt there will be intense debate now about “the decline of the Premier League”. Obviously there is not one single reason for the present situation, but there is one major reason that has not, in my view, been given proper consideration: the pound has lost around 25 per cent of its value over the last two years. Therefore the purchasing power of English clubs has decreased significantly.

To ensure the kind of dominance observed by top English clubs in the 2003-2009 period, the Premier League needs constantly to buy talent, the best talent, from all over Europe. With the pound reaching peak values over the period 2001-2008, and with the help of rich investors, English clubs have bought lavishly and have ruled the continent, broadly speaking.

But the pound has since fallen sharply (see graph, left, courtesy of Wolfram|Alfa). The pound was still at 1.30 euros to £1 in mid 2008, ahead of the summer transfer window before the 2008-2009 season. But with the pound flirting with euro parity in early 2009, and at around 1.17 in mid 2009, it is easy to see how some clubs could be hampered in last summer’s transfer market.

Other contributing factors to lower spending by England’s clubs include a lower than previous amount of investment by Roman Abramovich in his Chelsea team, the debt burdens at Liverpool and Manchester United, and the inflation in wages for top players, pushed partly by Manchester City’s spending on players and pay under the regime of Sheik Mansour.

To put it simply, English clubs sold stars in 2009, and bought fewer players themselves. This was notable among the “big four” especially. Look at key trades from last summer alone and you can see the big clubs were letting go more valuable (better) players than they were bringing in, not least at Manchester United (Ronaldo, Tevez out), Arsenal (Abdebayor, Toure out) and Liverpool (Alonso out). At those three clubs there was net transfer income, not spending, while at Chelsea investment was at a much more reasonable level than in the middle of the decade when money was flowing freely.

We knew this at the start of the season, hence my hunch that English clubs would be likely to find opponents relatively tougher in Europe this season.

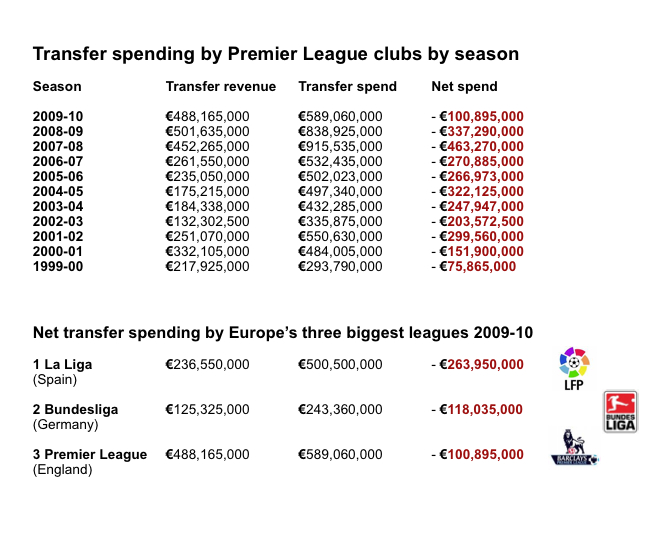

We can demonstrate how the Premier League’s net spending in transfer windows in the current season is at its lowest for a decade. I have taken the summaries of seasonal numbers in the table below from the transfermarkt.de website. Also note that in the 2009-10 transfer market, the Premier League’s ranking fell, for the first time in 10 years, from first place in terms of net spending in Europe, to third place, below the top division in Spain’s La Liga and Germany’s elite in the Bundesliga.

It may not be fully incidental that Arsenal and Manchester United fell in the Champions League to teams from precisely those two leagues.

The issue of exchanges rates and their effect on football has been sporadically raised in the British media, as in this Gabriele Marcotti piece in The Times last year, in this by Martin Caparrotta in The Sport Review, and on the BBC website last summer.

Interestingly, the same phenomenon as has happened in football has happened in rubgy union, with the weak pound provoking an exodus of top players towards France and Ireland, as these linked articles in The Telegraph and Daily Mail explore.

As a result, this season’s European Cup results mirror those of the Champions League with, for the first time – if you exclude the period of the boycott of the competition by English teams – only one English team in the quarter-finals of the Heineken Cup. For the three previous seasons, there were three English sides in the last eight, plus one finalist in 2008-09 and both finalists in 2006-07.

As with football, exchange rates are not the only reason for this change (there is no salary cap in French rugby), but the similarity between both situations goes beyond sheer coincidence and has it roots in common factors.

So it would be somewhat unfair to criticize English Premier League football teams and management for any decline in quality in the terms of Champions League performances. The fall of the pound has an automatic negative effect on the purchasing power of the league.

If you add the staggering debts of top clubs, the will of the Uefa to cap spending on players as a function of clubs’ turnover, and the Ofcom ruling on Sky’s selling prices, it is a fair to bet to say that the following years won’t look like the 2003-2009 era.

.

Lionel Page is an economist at the University of Westminster and the University of Cambridge. Among his recent research, he has investigated the influence of crowds on referees’ decisions in the Premier League.

More on that work can be found via this link to the Journal of Economic Psychology.

.

NFL has fairest pair distribution of major sports leagues in the world

4 comments

Brilliant article!

Even the best team in Europe has only perhaps a one in five chance of winning the Champions League (according to bookmakers.) As such, I think luck has greater explanatory power over one year results than exchange rates. It is a flaw in the human brain that we tend to insert or exxagerate the narrative element, always describing events as under or over performance etc.

Luck, in the form of poor draws, close losses and unexpectedly bad on-the-day performances, was for me the greatest contributor to the bad results.

Over the longer term actual results could be considered a valid set of data, but over just one season luck dominates. That is not to say that exchange rates did not have an influence, just that,

a) It is too early to necessarily see it in the results with confidence

b) Other variables in my estimation would have had stronger power

Love your article! Great to see such depth of thought about football!

I agree with the comment of Stephen Driscoll – luck is much more important season to season. Interesting aricle but I’d have to disagree with most of the thesis. Yes the pounds has been a contributory factor but:

(a) English clubs still have and have had much higher revenues, and much higher wage spending, than most of their competitors

(b) nearly all of the key players in big four English clubs were there before the fall of the pound and many are on contracts signed before the fall of the pound

(c) transfer spending (the figures used) does not correlate to on-field success whereas wage spending does, and

(d) it’s basically a cup competition anyway so v difficult to try and draw conclusions of trends either way.

The big untold story is more how poorly English clubs have performed in Europe in general. 3 European Cups (+ 4 runners ups) and 1 UEFA Cup (2 runner ups) in the 20 years since the ban ended is a very poor return indeed, considering that on average EPL clubs have 50% higher revenues (with, until very recently, lower top rate tax and much lower social security costs) than their counterparts. The English big 4 are in the top 7 highest-earning clubs in the world (Deloitte Richlist).

Amongst the many explanations, the main reason for me is the relatively poor standard of youth development in our country (so more talent has to be bought in) and, linked to that, the absence of a real technical football culture. But that’s another story…

Kylie BattName

Interesting to note the specifics of which clubs spent what in the transfer window this season; this courtesy of Des Kelly’s column in Saturday’s Dail Mail:

“But look at the top five clubs in Europe by net transfer expenditure this season and they are: 1. Real Madrid – £226million. 2. Manchester City – £128.4million. 3. Barcelona – £98.45million. 4. Inter Milan – £83.24million. 5. Lyon – £70.17million. Avert your gaze from Madrid’s European catastrophe and City’s immense gamble to force their way into the Champions League elite, and you are left with three of the four European semi-finalists.

Read more: http://www.dailymail.co.uk/sport/article-1264949/Des-Kelly-Why-did-flop-Europe-Look-spent-money-.html#ixzz0kpDuD8Uv